We sometimes joke about the government’s ability to pay social security benefits in the longer-term. While an overhaul to the program is certainly needed, those of us nearing retirement should feel fairly confident that our benefits will be paid when it comes time to file. If you are, in fact, getting close to retirement then social security benefits will play a substantial role in your overall retirement income strategy. Many of us already know that the Social Security Administration (SSA) allows you to start receiving benefits as soon as you reach the age of 62. However, the most important question for anyone to consider is, “should you?”

Your benefits amount and the age you file

Monthly social security benefit payments differ substantially depending on when you start receiving them. The longer you wait (up to age 70) the larger your benefit amount will be. If you elect to take benefits sooner, that amount will be reduced accordingly. They are reduced even further if you decided to take benefits prior to your full retirement age. You have no doubt seen this type of information reflected on your social security earnings statement. If you do not have a recent statement from the SSA, or have never received one, you can always create an online account at www.ssa.gov/myaccount/ to get more detailed information about your specific benefits.

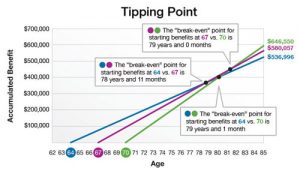

So how does the SSA figure out your benefits amount based on what age you file? From their point of view, it’s simple: If a person lives to the average life expectancy, that person will eventually receive roughly the same amount in lifetime benefits no matter what age he or she chooses to start receiving their benefits (see chart below). You might think of this as “breaking even”. If you file early, the SSA pays you less but assumes you will have more years of collecting benefits, and vice versa. In actual practice it’s not that straightforward, but the principle still holds. The key phrase here is “if the person lives to average life expectancy.” For example, if you exceed the average life expectancy and you opted to wait to collect benefits then you would start to accumulate more than the SSA had actually planned. It can also work in the opposite direction in that someone who elects to receive benefits early but passes away prior to the average life expectancy would accumulate less.

The chart shows how Social Security benefits accumulate for individuals who started to receive at ages 64, 67, and 70. The person who started to receive benefits at age 64 would accumulate $536,996 by the age 85. Conversely, the person who started to receive benefits at age 70 would accumulate $646,550 by the age of 85. Assumes the maximum monthly retirement benefit of $2,533 at age 67. Does not assume COLA. Source: Social Security Administration, 2013.

When should I begin collecting?

There is no “right” answer to when you should start taking benefits. Many folks base their decision on family considerations, economic circumstances, and personal preferences. If you have a spouse, the decision about when to start benefits gets more complicated—particularly if one spouse’s earnings were considerably higher than the other’s. The timing of spousal benefits should be factored into your social security income strategy. For example, if you file for spousal benefits at your full retirement age you may be entitled to half of your spouse’s full retirement amount. This is just one example and the decision making behind when to file for benefits is unique to each person’s own personal financial situation.

As you consider when to start taking Social Security benefits, it can be a good idea to factor in all the assets you have gathered for retirement before you make a decision. Ask yourself, “What other income sources are available to me aside from social security benefits?” Do you have a pension, an annuity, or money saved in retirement accounts like an IRA? Do you have substantial after-tax investment assets? Next, take the time to match your total retirement income against your projected annual expenses to see whether there is an excess or shortfall. This will help in making a more thoughtful decision on the timing of your benefits. In addition, folks that have substantial investment portfolios may want to consider drawing from these assets first and delaying social security benefits. The reasoning behind this is fairly straightforward in that each year you delay taking social security beyond your full retirement age you receive a guaranteed increase in your benefits amount. According to the Social Security website, people born in 1943 or later would obtain a yearly rate of increase of 8.0% by delaying benefits beyond full retirement age.1 Considering that positive returns on your investment portfolios are never a guarantee, it is not a bad way to gather extra income for retirement!

What’s the next step?

If you are nearing or even in retirement and considering what strategy might be most prudent for your situation think about contacting the Social Security Administration directly to setup an appointment and speak with a representative in your local office.

If you work with a financial advisor, like Sensenig Capital, contact them to discuss your options. Many firms have the ability to help you make this important decision in the broader context of your financial life. Remember, deciding when to take social security is both objective and subjective, but a decision that is not aligned with your retirement and life goals can cost a considerable amount of money over the long-term.

References: 1. Social Security Administration. Retirement Planner: Delayed Retirement Credits. www.ssa.gov/retire2/delayret.htm