Ben Edwards at the Money Smart Life blog was kind enough to include a recent guest post from our firm about the importance of distinguishing between brokers and fiduciaries. It’s not something that most people know to look for when hiring an advisor, but it makes all the difference in the world. Below is a summary of the post:

Most people find a financial advisor by word-of-mouth. You might ask a friend or colleague who they hired when it was time to start thinking about retirement. Or, perhaps a family member left you a sizable inheritance and you are not sure what to do so you ask around for a recommendation. Either way, when you begin to search for a financial advisor you want to work with a professional that you can trust and that has your best interests at heart; especially since you will most likely be working with that person for many years. So, how best can you determine whether you are making the most appropriate decision? One important item to consider is the difference between a “broker” and a “fiduciary”.

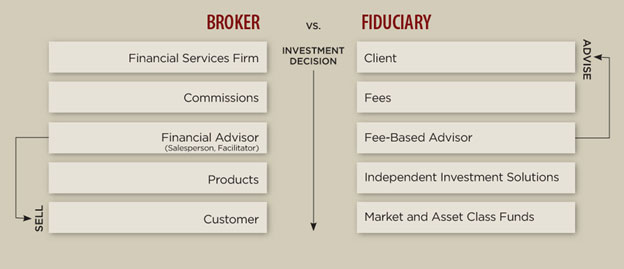

The chart below is another way to visualize this difference. The brokerage model on the left puts the customer on the bottom, behind commissions and products. The fiduciary advisor model on the right puts the client at the top, ahead of everything else. To read more on the Money Smart Life blog click here.