In the days immediately following the recent US presidential election, US small company stocks experienced higher returns than US large company stocks. This example helps illustrate how the dimensions of expected returns can appear quickly, unpredictably, and with large magnitude.

Average returns for US small company stocks historically have been higher than the average returns for US large company stocks. But those returns include long periods of both strong and weak relative performance.

Investors may attempt to enhance returns by increasing their exposure to small company stocks at what appear to be the most opportune times. Yet this effort to time the size premium can be frustrating because the most rewarding results often occur in an unpredictable manner.

A recent paper1 by Wei Dai, PhD, explores the challenges of attempting to time the size, value, and profitability premiums.2 Here we will keep the discussion to a simpler example.

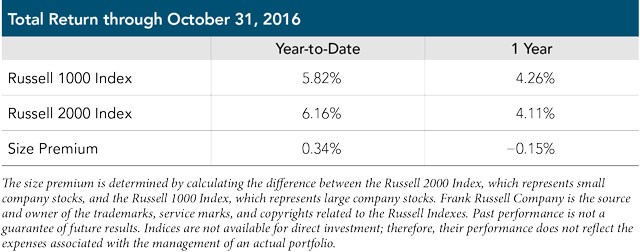

As of October 31, 2016, small company stocks had outpaced large company stocks for the year-to-date by 0.34 percentage points.

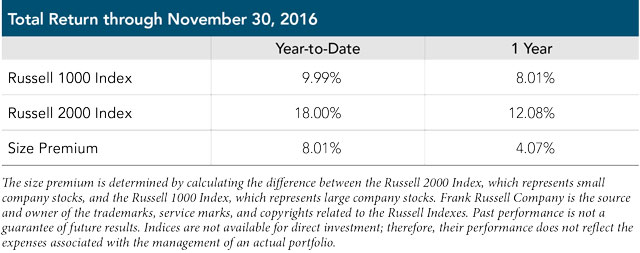

To the surprise of many market observers, the broad stock market rose following the US presidential election on November 8, with small company stocks outperforming the market as a whole. In the eight trading days following the US presidential election, the small cap premium, as measured by the return difference between the Russell 2000 and Russell 1000, was 7.8 percentage points. This helped small company stocks pull ahead of large company stocks year-to-date, as of November 30, by approximately 8 percentage points and for a full one-year period by approximately 4 percentage points.

This recent example highlights the importance of staying disciplined. The premiums associated with the size, value, and profitability dimensions of expected returns may show up quickly and with large magnitude. There is no guarantee that the size premium will be positive over any period, but investors put the odds of achieving augmented returns in their favor by maintaining constant exposure to the dimensions of higher expected returns.