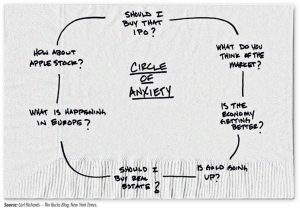

Occasionally, we get asked whether someone should buy a specific investment. We also get asked about the market, the economy and specific things like gold, the Facebook initial public offering, or the European debt crisis.

All of those things are very interesting and they seem to be something we spend a lot of time talking about and debating. But you have to wonder if our obsession with current events and specific investments focuses on the wrong questions.

What if the better question to ask is, “Does this investment fit in my plan?” If your answer is, “Plan? What plan?” that gets to a broader issue seen among many do-it-yourself investors.

While it may be interesting to talk about specific investments, it’s far more important to get a plan in place first. Only then should you go looking for specific investments to populate that plan. It’s kind of like figuring out where you’re going on a trip before you decide the mode of transportation to get there.

When we focus on the wrong question (“should I have gotten in on the Facebook I.P.O.?”), we’re more likely to make poor decisions based on short-term thinking and emotion. Instead, we ought to realize that we may not even know the correct answer to the bigger questions about our long-term plans.

We don’t know how the most recent I.P.O.’s will perform. We don’t know how things will work out with the European debt crisis. We don’t know what will happen to the price of gold. But if we have a plan, we can know whether those things have a place in our long-term strategy.

Let’s take the I.P.O. example. We would argue that in most sound investments plans, I.P.O.’s rarely fit. That one hot I.P.O doesn’t provide most investors with the essential diversification they need. So if you’re debating the question of whether to buy, you should do so on the basis of answering the question, “Does it fit?” If the answer is no, move on. Go back to what you were doing before, which was, hopefully, enjoying your life.

Depending on your plan and your situation, it may make sense to commit capital to a popular stock or an I.P.O. Perhaps it’s important for you to own a small allocation of an individual stock for work reasons, or maybe you just enjoy the idea of having a little “play money” to invest. Whatever your reasoning, it needs to be a part of your plan.

It may look like this: I will allow myself to use up to 5 percent (this as an example; your number could be different) of my investments as play money, but I will not allow it to go higher. It is super important to understand the value of having that cap specifically spelled out in your plan.

When we start to make investment decisions in isolation, without understanding the why of those decisions in the context of our lives, we tend to do things emotionally. And emotion makes it that much easier to commit the classic behavioral mistakes, like buying high and then later selling low.

As simple as it sounds, it all really goes back to the idea of asking the right question.

This article was adapted from and originally appeared on the New York Times Bucks Blog on May 29, 2012. Carl Richards is a certified financial planner in Park City, Utah, and is the director of investor education at BAM Advisor Services. His articles and sketches are archived on http://www.nytimes.com/interactive/your-money/carl-richards-gallery.html