Fixed income can play an important role in a portfolio. But its role may vary according to an investor’s financial needs and concerns. Many investors look to fixed income for safety and stability in their portfolios. However, low interest rates have sent many investors on a quest for higher-yield bonds or alternative investments. Depending on your approach, this pursuit of yield may invite more risk—some of which may be hard to see or understand.1

So, what’s an investor to do? How can you make prudent fixed income decisions while also addressing today’s low interest rates? Consider these principles:

Remember How Markets Work

At Sensenig Capital we believe that the same core investment principles apply in any market environment. One such principle is that in a well-functioning capital market, securities prices reflect all available information. Today’s bond values reflect everything the market knows about current economic conditions, growth expectations, inflation, Fed monetary policy, and the like. So, accordingly, the possibility of rising interest rates is already factored into fixed income prices.

This is one reason investors should view future interest rate movements as unpredictable. Even the market experts who have access to vast amounts of research have a hard time predicting the direction of interest rates. For instance, despite regular predictions of rising interest rates over the past two years, nominal yields on US Treasuries and longer-term bonds have continued falling and now are at historic lows.

Rather than trying to predict macroeconomic forces that are difficult to foresee, investors can look to the market to set prices and focus on the variables within their control.

Start with a Clearly Defined Goal

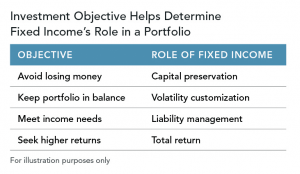

Fixed income choices should follow a broader investment strategy that defines the role of fixed income in a portfolio. The portfolio can then be customized to meet those specific goals while managing tradeoffs.

The chart to the right illustrates how portfolio objectives can influence a fixed income approach. An investor who wants to seek to avoid losing market value might have a different fixed income allocation from someone who wants to take a balanced approach, needs immediate income, or is seeking higher returns. Investors with different objectives typically have different tradeoffs regarding risk, expected return, and costs.

Understand the Tradeoffs

When reaching for higher yield, investors should carefully consider the potential effects of their decisions on expected portfolio performance and risk. In the fixed income arena, investors have two primary ways to increase expected yield and returns. They can:

- Extend the overall maturity of their bond portfolio (take more “term” risk).

- Hold bonds of lower credit quality (take more “credit” risk).

These may be reasonable actions. But pursuing higher income means accepting more risk, as measured by interest rate movements, price volatility, or greater odds of losing value if the issuer defaults.

Consider a Global Fixed Income Strategy

Investors have other tools to enhance risk and expected returns in fixed income. You can expand your opportunity set by moving beyond domestic fixed income to global markets. By owning bonds issued by governments and companies from around the world, investors can enhance diversification in their fixed income portfolios. After hedging against currency risk, bond markets around the world have only modest correlations. (Correlation refers to how similarly two investments perform in the same period.) As a result, a global hedged portfolio should exhibit lower volatility than a single-country portfolio and offer the opportunity to take advantage of more attractive yield curves abroad.

In summary, no one really knows when and by how much interest rates will change. Many market pundits have forecasted an upward move for several years now. Investors looking for higher bond yields should understand the higher risks tied to their decisions.

1. When interest rates rise, the value of an existing bond declines; when rates fall, existing bond values rise. The market adjusts a bond’s price to match the yield available on a new instrument. Investors who hold fixed income securities with longer maturities are exposed to the amplified effects of term risk. A long-term bond is more exposed to rate changes than a short-term instrument, and usually (but not always) offers a higher yield to compensate investors for the extra risk. Also, lower-coupon bonds are more affected by interest rate changes than higher-coupon bonds. For example, if rates move 1%, a bond that pays 3% will experience a greater gain or loss than one paying 5%.