As we are all now well aware, on January 1st, the U.S. Senate and House of Representatives adopted a compromise to address many of the major budget issues that were related to the so-called “fiscal cliff.” In the early hours of the New Year, the Senate voted to extend the Bush-era tax cuts for most Americans, with higher-income taxpayers facing a rate increase. The Senate measure was later approved by the House, and President Obama subsequently signed it into law.

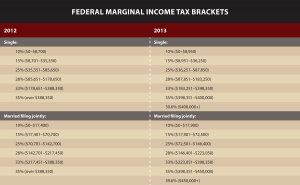

The legislation includes the following provisions (also see chart for a comparison of 2012 and 2013 tax rates):

- For most taxpayers, income tax rates would remain unchanged.

- Individuals earning more than $400,000 and couples earning more than $450,000 would be subject to a higher (39.6%) top marginal rate.

- These same upper-income earners would face an increase in capital gains and dividend tax rates from 15% to 20%.

- Individuals earning more than $250,000 and couples earning more than $300,000 would see the return of a phase-out on personal exemptions and itemized deductions.

- The tax rate on large inheritances (estates valued at $5 million for individuals and $10 million for couples, indexed for inflation) would rise from 35% to 40%.

- The portability feature regarding estates that allows for a transfer of any unused exclusion to the surviving spouse remains intact.

- The alternative minimum tax (AMT) would be permanently adjusted for inflation, preventing more families from being subject to the AMT.

- 401(k) and other defined contribution retirement plans could provide plan participants with a newly expanded opportunity to convert their pre-tax savings within plans into Roth savings.

- The IRA charitable rollover provision will be extended for 2012 and 2013.

- Unemployment benefits will be extended for one year.

Many other issues—particularly on federal spending related to the debt ceiling—were not addressed in this compromise. They will likely be taken up as part of the upcoming debate over raising the federal debt ceiling and navigating scheduled automatic federal spending cuts that were postponed by the current legislation.

What to do, if anything?

If you’re concerned about the impact of these developments on your investments, you’re certainly not alone. Regardless of current market or economic conditions, Sensenig Capital believes an investor’s best strategy for dealing with uncertainty is to stay focused on your investment plan. Letting emotions dictate your actions can lead to making financial decisions you might later regret. A very prudent way to handle this, while still addressing your concerns, is to have a conversation with your financial advisor or tax counselor about potential impacts to your unique financial situation.

No matter what happens in Washington, here are a few thoughts to keep in mind:

- Don’t let taxes drive your investment decisions: Make sure any tax-related decisions are truly in line with your long-term financial goals. As an investor, mitigating taxes should be an important factor to consider but it is secondary to your ability, willingness, and need to take risk. For example, ask yourself if you are choosing to buy or sell an investment because of changes in tax rates and speculation about where they might go in the future. If the answer is yes, then consider a thorough review of your investment plan first to ensure that the decisions you make are in line with your long-term goals and circumstances.

- Consider year-round tax planning: It’s important to keep taxes in mind throughout the year. Doing so gives you plenty of time to evaluate your situation calmly and make changes when truly necessary.

- Avoid market noise: Given the anxiety over the current tax landscape, a certain amount of market volatility is possible. However, as with any such turbulence, the best advice is often to sit tight and stay diversified.