As human beings we use “schemas” in everyday life. A schema is a psychological term used for shortcuts we develop in our mind to help us quickly associate something. When you hear the word car, you see a picture of a car in your mind. You may also have emotional connections to cars—perhaps you and your father worked on them when you were a kid, or you were in a bad car accident at some point.

Since schemas are such an important part of our daily lives, let’s try this exercise: when you read the term international investing, what type of association immediately enters your brain? Perhaps you thought of increased risk, more volatility, or a sense of the unfamiliar. If so, you are not alone, especially in light of a number of world events during the past few weeks. Many U.S. investors view domestic investments as being safer than international. On the surface this may seem logical, but behavioral finance studies have shown this to be a common error in confusing familiar with safe. Are they really more risky, or is that just our assumption? If they do come with more risk and the potential for greater returns, can we somehow take advantage of this?

In the remainder of this article, we will examine how international investments can potentially increase your return and lower your risk. Let’s now challenge our schemas and look at this topic in greater detail.

Increasing return / lowering risk

By investing abroad, you gain exposure to companies operating in other countries with potentially unique products and consumers that weather market downturns and upturns differently than the United States. Variances in household income, population demographics, availability of resources, export strength, and currencies (among other things) allow international economies to behave differently than ours. In addition, the decreasing share of the world economy attributed to the U.S. equates to more of a need for domestic investors to consider the validity of adding international assets to their portfolio.

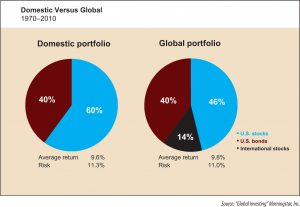

The common misconception in allocating a percentage of your assets to international equities is that they are too risky. In isolation that may be true, but what really matters is the effect it has on your investments as a whole. According to Larry Swedroe, author of The Only Guide to a Winning Investment Strategy You’ll Ever Need, adding international exposure to a portfolio consisting of mainly domestic investments will actually increase the projected annual return and decrease the total level of risk. More specifically, the potential increase in return is attributed to the additional growth potential within international, and the decrease in risk is due in large part to the additional diversification gained above and beyond domestic equities. The chart below labeled “Domestic Versus Global” illustrates this point nicely as you can see the effect of adding a small percentage of international stocks. In addition, an investor can achieve even more benefit by diversifying further amongst international large-cap, small-cap, and emerging markets. What makes this concept come to life is what’s known in the investment world as correlation.

Relationships are important

Correlation is a statistical measure designed to quantify the interrelationship between two investments. That is just a fancy way of explaining how we can compare the movements of two investments. For example, if investment A declines in value and investment B increases in value, they would be considered negatively correlated. This means they tend to move in different directions. Conversely, if both tend to move in the same direction, they are considered to be positively correlated. The graph below shows an illustration of these relationships. Correlation, and its relationship with the diversification of assets, is the reason for a potential increase in returns and lower level of total portfolio risk.

It is important to remember that historical correlations—just like investment returns—are not static. One might ask whether diversification itself is important at all given the recent recession when, for a portion of time, it seemed that no matter which asset class you owned they all seemed to drop in value. Sometimes events like this occur and asset classes seem to correlate positively. However, in the long-term, investors can typically expect equity markets to perform quite differently, and the investor will see the benefits of diversification more clearly. The level of allocation an investor chooses toward international equities is unique to their own ability, willingness, and need to take risk. In a general sense though, how much should you consider allocating your investment assets toward international? Let’s peruse that thought.

International allocation

In The Future for Investors, author Jeremy Siegel notes the importance of international investing as it relates to the allocation of the world’s equity. For example, the U.S. is now roughly 50% of the total world stage. He says, “The reality of most investors’ portfolios is very different from the market value-based allocation. Recent data show that U.S. investors, both professional and individual, hold only 14 percent of their stocks in non-U.S.-based companies…” This is known as home equity bias and results in part because U.S. investors believe they have greater knowledge of (and therefore greater comfort in buying) domestic companies. Notice anything familiar? Investors’ schemas are being used to associate the familiar with the safe. In the longer-term, this mentality could lessen the potential for greater investment returns at lower risk. So, if we are willing to consider international investments, how much is appropriate to own as compared to our domestic counterparts?

According to David Laster in the Journal of Investing, historical evidence suggests that raising the international allocation to roughly 40% of your overall equity allocation can substantially reduce overall portfolio risk. For example, in a balanced 50% equity and 50% fixed income portfolio, you would consider allocating 40% of the equity side to international investments. In dollar terms, a $1 million portfolio with $500,000 of stocks (50%) would consider allocating $200,000 to international stocks. Of course, it is important to keep in mind that every investor’s tolerance for risk is unique to themselves and their own personal circumstances, so what is appropriate for investor A might not be appropriate for investor B. Generally, one should consider what makes the most sense as it relates to their overall investment plan. The most suitable allocation should be determined at the outset of your investment planning and should not be dictated by short-term market conditions. Finally, it is important to recognize the need for an appropriate amount of high-quality fixed income to balance the level of risk in the overall portfolio. Getting this right is the most important asset allocation decision an investor will make.

To summarize, given the gradual reduction of the U.S. dominance in the world and the emergence of a more global economy, investors are wise to consider an allocation of their investment assets to international. The benefits to one’s own long-term investment plan are evident, as the research shows. So now, when you think about the words international investing, what is your schema telling you? Perhaps you are not yet convinced—but just remember that diversification has been said to be the closest thing to a free lunch in investing, so you might as well consider eating a healthy portion.