In a study of Baby Boomers commissioned by Allianz Life Insurance in May of last year titled “Reclaiming the Future: Challenging Retirement Income Perceptions,” 61% of the Baby Boomer generation feared outliving their money more than they feared their own death. Allianz CEO Gary C. Bhojwani stated, “These results are troubling not only because people are fearful about retirement income, but also because of how little they know about how much money they’ll need.” In The Wall Street Journal article entitled “Retiring Boomers Find 401(k) Plans Fall Short,” E.S. Browning notes, “The median household headed by a person aged 60 to 62 with a 401(k) account has less than one-quarter of what is needed in that account to maintain its standard of living in retirement.”

While these statistics are eye-opening, they are also not surprising. There are many things to consider when planning for retirement, but let’s assume you have already saved and invested during your working years and are now approaching or already in retirement. Like most people, you expect to live a comfortable retirement while making sure you don’t deplete your assets prematurely. This is a dilemma that many retirees encounter but for which few fully understand and plan. In the remainder of this article, we will touch on how to determine a safe rate of withdrawal from your retirement assets using both a modest rule-of-thumb and a more sophisticated simulation approach.

The “4 Percent Rule”

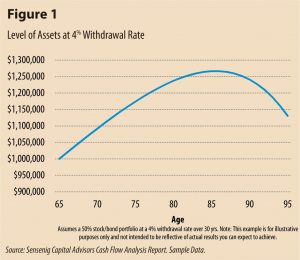

It is beneficial to have a proper starting point regarding the amount of money you plan to withdraw from your assets in retirement. At a basic level, financial advisors will often use the “4 percent rule.” This rule is derived from a study entitled “Retirement Spending: Choosing a Sustainable Withdrawal Rate” and is more commonly known as the Trinity Study. The results of the study showed that, generally, an investor with an asset allocation of 50% stocks and 50% bonds would have a 95% historical success rate over a 30-year time horizon using a 4 percent rate of withdrawal, adjusted for inflation. Using the previous information, a retiree with a portfolio of $1 million could safely withdraw roughly $40,000 per annum to provide for living expenses without depleting his or her assets over time (see fig. 1). While this is a simplistic example, it does highlight the need to align the amount of money available in retirement to realistic living expenses – an often overlooked but highly important aspect of planning for the future. In addition, the Trinity Study concluded that:

-

Younger retirees who anticipate longer payout periods should plan on lower withdrawal rates.

-

Withdrawal periods of longer than 15 years dramatically reduced the probability of success at withdrawal rates exceeding 5%.

-

Retirees who desire inflation-adjusted withdrawals must accept a substantially reduced withdrawal rate from the initial portfolio.

At Sensenig Capital, we use the “4 percent rule” regularly with clients to provide a basis in budgeting retirement outlays. However, there are other variables to consider such as projected time horizon, actual spending amount, personal health situation, investment returns, etc. In his book entitled The Only Guide You’ll Ever Need for the Right Financial Plan, Larry Swedroe states, “The good news is that you have some control over each. The bad news is that you are not in complete control over any of them.” Mr. Swedroe goes on to say, “Most people have some control over their retirement age…[and] while you cannot control investment returns, you can decide on an asset allocation giving you the expected return required to support your needs.”

It is important to be conservative in your assumptions as well, because when it comes to planning for your retirement, the penalty of outliving your money is greater than the penalty of dying with money. As we often mention at Sensenig Capital, there are many moving parts to the investment process, and the nature of what we do is very dynamic. Therefore, as we begin to offer comprehensive financial planning as a complement to our expertise in investment management, clients will have the opportunity to take advantage of a robust approach to formulating the most appropriate withdrawal rate. This process is known as Monte Carlo simulation.

Monte Carlo Simulation

Remember your old statistics class? If so, it probably brings back the fondest of memories from high school or college. Ah, outliers and probability distribution! Nonetheless, Monte Carlo simulation is essentially a statistical way to use a set of assumptions regarding investments, time horizon, asset allocation, withdrawal rates, etc., to view outcomes of differing strategies in order to see how marginal changes in one’s plan affect the odds of success. Using this method is favorable in that it can help to establish a balance between the willingness/need to take risk and the necessity to provide for retirement expenses. In many ways, it is a more sophisticated version of the “4 percent rule.”

Take, perhaps, Susan Smith. Susan currently has $800,000 of investable assets, a goal of retiring in 15 years with $2 million, and she would like to draw $80,000 annually in retirement to fund her living expenses. Assume also that Susan is only willing to hold a portfolio of 50% stocks and 50% bonds. As a result of using Monte Carlo simulation, Susan might have an 80% chance of achieving her goal at retirement. Perhaps she is risk averse and will only accept a 95% or higher probability of success. Given the outcomes, Susan now has several options: (1) she can accept more risk in her investment portfolio to increase the potential of reaching her goal on time; (2) she can lower her goal of $2 million at retirement; (3) she can save more during her working years; or (4) she can accept the 20% risk of her plan possibly ending in failure. As you can see, the use of probabilities allows us to focus on an individual’s ability, willingness, and need to take risk and to adjust goals accordingly.

From an investment point of view, the results in the example above can be evaluated to see how changes in asset allocation impact the odds of success. A change in allocation to accept more risk (70% stocks, versus 50%) will yield a more favorable chance of success but not without an increase in risk, of course. Whatever the case may be, the sensible answer is unique to each individual situation. Some clients might be comfortable with an 80% chance of success while others would not accept anything less than 95%, like Susan. These decisions are all preference driven by personal choice and, according to Mr. Swedroe (referenced above):

-

The more risk averse the investor, the more emphasis should be placed on the odds of not running out of money rather than those of creating a large portfolio.

-

The lower the odds of success that can be tolerated, the more options an investor is both able and willing to exercise if risks do show up – for example, the ability to downsize the cost of living if investment returns are not what had been assumed.

In conclusion, the Allianz Life Insurance study mentioned previously shows us that most Baby Boomers have little idea of how much money they will need to support themselves in retirement. According to the study, “When asked how much yearly income is needed in retirement, respondents indicated a median income of $59,000 per year. Unfortunately, Boomers were off by a factor of nearly three times too small when estimating how much they’d need to save to create that household income.” The question of whether one will run out of money can be addressed, in part, by taking into account the two approaches outlined above. Nevertheless, despite the alarming nature of these facts, they can help to make people more aware of the need to take greater control over their financial lives. Partnering with an experienced and thoughtful advisor is a wonderful first step and certainly worth it, given the poignant fact that you are planning the remainder of your life’s financial future.