Wealth management is not a new term. Most people have heard about this concept but are unclear what exactly it encompasses. So we ask, “What separates a wealth manager from an investment advisor?” If you’re unsure how to answer this then you are certainly not alone. In fact, a recent study by leading consulting firm, CEG Worldwide, concluded that out of almost 2,100 so-called wealth management firms across the country only 7% were truly engaging in actual wealth management. The rest were mainly investment-oriented. Therefore, what is this mystifying profession and what should clients be looking for in a “true” wealth manager?

Wealth management defined

It’s important to realize that wealth management is a highly defined process that consists of several key components. Genuine wealth managers use a consultative approach to construct integrated solutions that encompass all types of financial needs.

In its simplest form, wealth management comprises three phases:

- Using a consultative process to establish close relationships with a client in order to gain a detailed understanding of their goals and their most important financial wants and needs.

- Offering customized solutions designed to fit each individual’s needs. This might include; investments, insurance, estate planning, retirement planning, and charitable giving.

- The wealth manager works in close consultation with clients and their other advisors—such as their CPAs, estate planning attorneys, and insurance providers—on an ongoing basis to identify their specific needs and design custom solutions.

The wealth mgmt. formula: WM = IC + AP

At its core, the wealth management (WM) approach is comprised of investment consulting (IC) plus advanced planning (AP).

The first element of the equation, investment consulting, plays an integral role in the long term success of your goals and objectives. Your investments are the engine behind the other planning of your financial affairs. We leverage the experience and time-tested philosophy that Sensenig Capital has developed over many years to provide you with a custom, tailored approach. While many firms have seen fit to outsource the management of their client portfolios to third-party vendors, we gain an edge by fully and intelligently understanding the investments we recommend to you and why. Affluent clients expect this, and, in our opinion, there should be no substitute.

The second component of the equation is advanced planning. The intention here is to ensure that your financial house is in order so that you can fully achieve your goals. Industry research is clear in that financially successful people are concerned with much more than just their investment assets. In fact, preserving wealth is often more important than growing wealth. Thus, the various components of advanced planning speak to the key concerns of many clients, including wealth enhancement through income tax mitigation, wealth transfer via estate planning, and wealth protection through insurance.

The wealth management process

It takes a strategy to make the most of the opportunities that wealth can bring to your life. However, it cannot be just any strategy; it has to be your strategy. That’s why we created a “Discovery” process in which we dedicate considerable time and resources in getting to know more about your investment and advanced planning needs.

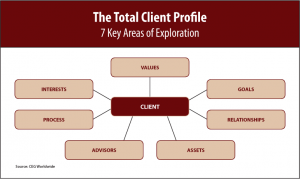

Discovery involves seven key areas of exploration centered on your particular needs, as shown in the illustration to the right. Our inquiry goes much deeper than the traditional fact-finding used by many advisory firms so as to reveal what really matters to you. This approach is an alternative to the traditional financial planning model that can oftentimes be expensive and cumbersome. Discovery sets the stage for an ongoing process that deepens our relationship with you and enhances critical communication about your life as it changes.

The trusted professional network

No one person can be an expert in an entire range of advanced planning needs and solutions. In a typical situation, your attorney might never collaborate with your accountant and the accountant may never seek the opinion of your investment advisor, and so on. Rather than each professional working in isolation we feel they should be working together to benefit you in a greater capacity. In order to address the totality of your financial challenges with the best possible strategies we have built a professional network of specialists to assist us.

This network is made up of independent professionals spanning in expertise from specialized income taxation to detailed estate planning, insurance, and various other areas of proficiency. We have carefully selected each person to reflect the same level of service and professionalism that our clients expect. Among other things, we look to work with someone based on competency, integrity, and their ability to remain objective in looking out for your best interests. Of course, if you are interested in the wealth management process but already work with someone else that is perfectly fine too.

Over the years we have come to understand the unique issues that affect affluent clients. We believe that consultative wealth management can serve to provide you with a holistic method in managing your complex financial affairs.