This material may refer to resident trusts offered by DFA Australia Limited. These resident trusts are only available in Australia. Nothing in this material is an offer or solicitation to invest in these resident trusts or any other financial products or securities. All figures in this material are in Australian dollars unless otherwise stated.

It’s around the December-January period when harried finance editors ask reporters to call investment professionals and cobble together top predictions for the coming year. These are fun to write. But for readers, they’re more entertaining a year later.

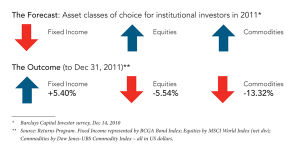

Take the late 2010 Barclays Capital Global Macro Survey of more than two thousand institutional investors. The pick for the best-performing asset class in 2011 was equities (with 40% support), followed by commodities (34%) and bonds (less than 10%).1 The consensus prediction was a 15% gain in the S&P 500 for the year to around 1,420.

As we now know, the truth turned out to be different. To the end of December and using broad indices, diversified fixed income was the best-performing asset class of the year. Returns from global equities and commodities were negative, the latter significantly so. The full-year return for the S&P 500 was a little over 2%, or 13 percentage points below the Barclays survey consensus. (And remember, these are the forecasts of big institutional investors.)

Barron’s, meanwhile, was telling readers at the end of 2010 that smart stock pickers were “looking eastward” in 2011. The year was to be dominated by fast growth and rising inflation, and the smart thing was to reweight toward China and other tigers.2

That didn’t really turn out to be such a good idea, as China had a bad year. The Hong Kong Hang Seng Index fell just under 20% in 2011. The Shanghai Composite fell by a similar amount, and the MSCI-ex Japan Index ended the year a little under 13% lower.

Conversely, the gloom around fixed income in late 2010 was all pervasive. Barron’s surveyed ten strategists and investment managers and found nearly all expected stocks to outperform bonds in 2011. “You’ve got to believe in outright deflation to put new money into bonds right now,” said one investment banker.3

The logic might have been impeccable, but the strategy wasn’t so. By the end of 2011, the Barclays Capital Global Aggregate Bond Index was up 5.4% for the year, its best performance since 2008.

In other words, bond yields might have been seen as unusually low in late 2010. But they fell even further over the intervening year, and those who tried to profit by market timing or making concentrated bets elsewhere paid a heavy price.

So if the experts can’t get the broad asset class movements right, what chance on earth have they of correctly and consistently predicting individual stock or commodity performances? But year after year, that doesn’t stop them from trying.

One prominent investment bank team was quoted by the Australian Financial Review last January as saying that platinum was the metal to back in 2011. By the end of the year, the spot platinum price was down nearly 21%. On the Australian stock exchange, platinum stocks Platinum Australia and Aquarius Platinum—both recommended by the bank—had delivered total returns of –87% and –56% respectively. Ouch!4

Stock picks often go wrong because forecasters base their calls on what turn out to be incorrect assumptions on macroeconomic variables like base lending rates and inflation. Take the AFR Smart Investor magazine “expert panel,”5 which in late 2010 suggested to readers moving out of international fixed income and into cash, given expectations of rising cash rates in Australia. As it turned out, Aussie rates did not move until November, and when they did the direction was down, not up.

Currencies are another variable that defy even the most assiduous forecasters. In its 2011 outlook published in the London Daily Telegraph6 in December 2010, a major British bank forecast sterling would be the year’s best-performing currency. The bank also predicted stock markets would outperform bonds, with the FTSE 100 rising about 18%. As it turned out, sterling ranked a distant seventh among major currencies against the US dollar in 2011—behind the Japanese yen, Swiss franc, Australian dollar, New Zealand dollar, Norwegian krone, and Swedish krona.7 Meanwhile, the FTSE ended the year 5.5% lower.

It’s a tough business, isn’t it? And, remember, these are major financial institutions with armies of expert analysts, mountains of data, and sophisticated forecasting tools. So what is an ordinary investor supposed to do?

The first lesson might be that forecasting is hard, particularly about the future! You can do all the analysis you want, but events have a way of messing with your assumptions.

The second lesson is you don’t really need forecasts to succeed as an investor. Yes, equity markets were rocky again this past year. But a properly diversified fixed income portfolio provided excellent returns. Staying diversified both across and within asset classes helps lessen the effects in down times and can keep it positioned to capture returns when riskier assets come back into demand.

The third lesson is that the past has gone. The news may be gloomy, but that information is in the price. When risk appetites are low, the price of safety is higher than at other times. But the expected reward for risk is higher. Conversely, when risk appetites are high, the expected rewards are lower.

It’s human to feel anxious about bad news because we fear loss more than we like gains. But in this case, the loss isn’t real unless you realize it, so it makes sense to stay with the asset allocation your advisor has tailored for you.

The final lesson is that nothing lasts forever. In fact, of all the forecasts ever made, the only one really worth counting on is that things change. What’s more, they often change in ways we least expect.

References

1. “For 2011, It’ll Be All About Equities,” Pensions & Investments, December 27, 2010.

2. “Asian Trader: Stockpickers, Look Eastward,” Barron’s, December 20, 2010.

3. “Outlook 2011,” Barron’s, December 20, 2010.

4. “Treasuries Rise on Concern Europe Struggling to Resolve Crisis,” Bloomberg, December 7, 2011.

5. “Platinum to Become the Price of Metals in 2011,” Australian Financial Review, January 7, 2011.

6. “How to Rebalance Your Portfolio in 2011,” AFR Smart Investor, December 17, 2010.

7. “Sterling Best Major Currency Next Year, says Barclays,” The Daily Telegraph, December 10, 2010.