Regardless of whether you are in retirement or saving toward it, the simple fact remains that without proper investment planning it is easy to drift off course and become distracted from your original goal. Paying close attention to the fundamentals during times of economic uncertainty is imperative to long-term investment success. It’s easy to second guess our plans when the landscape becomes vague. For example, think back over the past several years and ask yourself whether these statements have come across your mind:

“This recession has shaken my confidence and I believe things are different now, I need to consider changing my strategy.”

“Traditional investments (stocks, bonds, and cash) have not done well lately. I really need to consider alternatives such as gold, commodities, etc…”

“I’m not sure I see the market coming back for a very long time. I think it’s best if I go ahead and sell everything now.”

At the surface it is understandable why someone would ask these questions. Let’s face it, we’re only human, and in the face of indecision it is hard to know where to turn. The fact is, no matter how much you study economics or the markets, no one has a crystal ball. This is precisely the reason why we have a responsibility to focus our efforts on what we do know; we must focus on the goals we have set, the plan we have put in place, and our ability to follow through on each.

While we prepare for an expansion of our services at Sensenig Capital to include comprehensive financial planning, it is critical that we step back and reflect on the philosophy we have fostered for many years in order to help our clients achieve their goals through investment management.

Establish Goals

Defining exactly what you want to accomplish helps provide a connection between your life goals and your investments. Create a list of your priorities and rank them in order of importance. Saving for a comfortable retirement, helping children pay for college, or leaving money to heirs are all typical examples that come to mind. It is essential to remember that your current investment strategy is helping you work toward realizing each of these objectives. Without knowing exactly what you want to achieve, you cannot prudently select the right investment strategy to help get you there.

In addition, diversifying your investments is a good way to spread risk and avoid too much exposure to one asset class. This has always been a practical approach to the management of one’s investments, but what about diversification amongst advisors? Take for example Mr. Business Owner. He has been financially successful over the years, investing his money to provide for retirement. Mr. Business Owner decided it was best to use multiple advisors that would compete with each other over investment performance, hoping this would help him grow his assets even faster. This may seem like a sensible approach, but what Mr. Business Owner failed to realize is that his advisors in this example end up working independently of each other, and no one advisor knows what the other is managing. This leads to duplication of investment holdings, higher costs, and more volatility. More importantly, there is no coordinated effort to help Mr. Business Owner reach his original goal of retirement.

This situation is a no-win for both the advisor and the client. A healthier solution is to consolidate your investment accounts with one advisor whom you trust to assess your complete investment picture and help you deploy a strategy that is cost effective, prudent, and comprehensive. Whether it is a SEP-IRA, 401(k), profit sharing plan, a trust, a business retirement plan, or other assets, Sensenig Capital can assist in bringing everything together under one all-inclusive umbrella. We recommend this frequently as it allows for a more thorough review of your investment picture.

Plan Accordingly

Benjamin Graham, the mentor to Warren Buffett, drew a clear distinction between speculators and investors in his book The Intelligent Investor. People who use short-term economic news or market timing as an attempt to achieve investment success are described as speculators. Few realize that this approach is almost always futile, not to mention exceedingly risky. Prudent, long-term investors follow a strategy that has stood the test of time and stick to it in both positive and poor market environments.

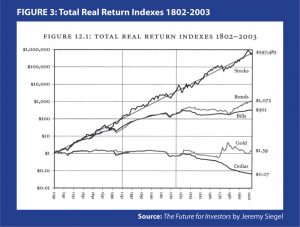

When formulating the most appropriate strategy, one of the most significant factors to consider is asset allocation. The universally accepted classes of assets used in constructing an investment portfolio are stocks, bonds, and cash. As most people know, each class is associated with its own level of risk and return. Generally speaking, bonds have less risk and more stability than stocks. According to Wharton professor Jeremy Siegel in his book The Future for Investors, on average, bonds have historically provided a return of about 3.5%. Stocks, on average, have historically returned roughly 7%. In addition, cash, which is known for its liquidity and safety, has only returned about 3%, historically. The chart provided here illustrates the historical difference between the returns of each asset class.

Using this knowledge, an investor can begin to build the most appropriate allocation to each asset class. For example, Jane and Steve currently have $1 million with a goal of retiring in 12 years with $2 million so that they can live on roughly $80,000 a year (4% of their assets at retirement). This means they would need their investments to achieve at least 6% to meet their goal. Based on the historical figures mentioned above, the probability of obtaining a 6% return is favorable with an asset allocation of roughly 70% stocks and 30% bonds.

While this is only one of many scenarios, it highlights the importance of thoughtfully planning for your goals and investing in a way that minimizes risk and maximizes the probability of success.

Follow Through

In our opinion, follow through is the most difficult aspect of investing. Sticking to a plan for the long-term can wear on the emotions of an investor regardless of whether times are good or bad. Most people are exposed to the markets through the lens of major financial media outlets who strive to deliver news that is attention-grabbing, yet short-term in nature. This kind ofinformation makes for good headlines but poor long-term investment principles. The point is that investors need to be mindful in sifting through the media “noise” to keep a clear focus on what is truly important. This is easier said than done. In the absence of regular communication between the client and advisor, goals can be lost and plans can become unclear.

Regular communication is imperative in making sure we review and discuss your plans, monitor your investments, and address any concerns you may have; there is no substitute. This may seem simple to most people, however it is at the foundation of what makes Sensenig Capital successful over its competitors. In fact, new clients will sometimes express discontent with a former advisor purely due to lack of communication. While this is unfortunate and fairly common, it gives us the opportunity to educate clients on the benefits of being proactive and communicating often.

In conclusion, there is much more to the investment management picture than what has been explained in this article. Keep in mind that it is easy to get caught up in one detail over another, but maintaining a focus on the fundamentals of establishing goals, planning, and following through will help guide you in the right direction. In the words of legendary cyclist Greg Lemond, “Perhaps the single most important element in mastering the techniques and tactics of racing [investing] is experience. But once you have the fundamentals, acquiring the experience is a matter of time.”