The need for retirement planning doesn’t end with the onset of retirement. A new retiree’s focus shifts from building wealth to managing and preserving it. One major challenge is to make the investment portfolio supply cash flow for the duration of your life—and through different economic and market conditions.

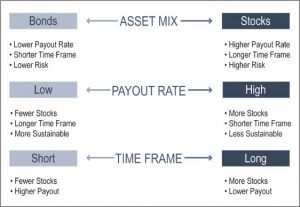

Experts have studied portfolio longevity or endurance to help retired investors reduce the odds of depleting their wealth too soon. The studies evaluate how a portfolio might endure under the stress of changing markets and spending levels. Three main factors drive portfolio endurance: asset mix, spending level, and investment time frame.1 Certain aspects of these factors are within an investor’s control while others are not. Let’s briefly consider them.

Asset Mix

Asset mix describes the ratio of stocks to bonds in a portfolio. This determines risk exposure and expected performance, and is one of the most important decisions investors of all ages can make. Historically, stocks have outperformed bonds and outpaced inflation over time. This reflects the higher risk of owning stocks.2 Consequently, the larger the equity allocation, the greater a portfolio’s expected return—and risk.

Keep in mind that risk and return go together. A higher allocation to stocks increases the risk of experiencing periods of poor returns during retirement. But if you can handle the risk, having more stock exposure in a portfolio enhances its return potential. Growth can bring higher cash flow, inflation protection, and portfolio endurance over time. This is why most investors should have an equity component in their portfolios, with actual weighting dependent on your ability, willingness, and need to take risk.

Spending Level

Portfolio withdrawal is typically described in terms of a specified dollar amount (e.g., $50,000 per year) or a percent of annual portfolio value (e.g., 5% of assets each year). Neither method is ideal, however—and for different reasons. Briefly consider each one:

Specified dollar amount: withdrawing a fixed amount each year and adjusting it for inflation can provide a stable income stream and preserve your living standard over time. But the portfolio may survive only if future withdrawals represent a small proportion of the portfolio’s value. Choosing a higher withdrawal amount is not likely to be sustainable, especially if the portfolio faces an extended period of negative returns.

Percent of annual portfolio value: withdrawing a fixed percentage of assets based on annual asset value makes it unlikely that you will deplete retirement assets because a sudden drop in market value would be accompanied by a proportional decline in spending. But this method can produce wide swings in your living standard when investment returns are volatile.

Investment Time Frame

Investment time horizon may be the hardest to estimate, especially if it is the same as your lifespan. In this case, you can only guess how long your portfolio must support spending. If you plan to bequeath assets, your investment time frame may extend beyond your lifetime.

Time frame forces a tradeoff between the short and long term. Retirees with a longer investment time horizon might choose a higher exposure to equities. But they may have to offset this risk by being more flexible about spending over time. Elderly retirees and others with a short time horizon may choose a less risky allocation or a higher payout rate, although they can experience rising spending levels, too. In any case, retirees should think carefully about equity exposure and avoid taking more risk than they can afford.

Considerations

Planning involves assumptions about the future—assumptions that may not pan out. Although you cannot avoid making assumptions, you can ask whether they are realistic and consider how your lifestyle might change if future economic and financial conditions are much different than projected. For instance, you may assume an average return based on historical performance. But there is no certainty that future portfolio returns will resemble the past, regardless of time frame. Moreover, short-term results may vary drastically, which could force hard financial choices. Investors should think in terms of probability, not history.

Managing asset mix, payout, and time horizon inevitably involves tradeoffs. The chart above illustrates the dynamics. For example, a bond-dominated portfolio with a lower expected return may suit investors with a shorter time horizon, or require them to accept a lower payout rate to increase the odds of portfolio survival. A portfolio with a higher allocation to equities may be appropriate for someone with a long time horizon or a strong desire for a high payout rate, but a higher assumption of risk also results in greater uncertainty about future wealth.

Finally, although you cannot fully control these and other factors involved in portfolio endurance in retirement, having more wealth can improve the odds of having a less stressful financial life. A more substantial nest egg might enable you to take fewer risks, enjoy a higher sustainable spending rate, or extend the productive life of your portfolio.

1. Cooley, Philip L., Carl M. Hubbard, and Daniel T. Walz. 1998. “Retirement Savings: Choosing a Withdrawal Rate That Is Sustainable,” AAII Journal 20: 16–21. Also see: Bengen, William P. 1994. “Determining Withdrawal Rates Using Historical Data,” Journal of Financial Planning 7: 171. 2. From 1926 to 2009, the S&P 500 Index returned an average 9.8% per year compared to 5.4% for long-term government bonds and 3.0% inflation. Sources: Standard & Poor’s Index Services Group for S&P 500 Index; long-term government bonds and inflation provided by Stocks, Bonds, Bill, and Inflation Yearbook®, Ibbotson Associates.