Source: Christiaan Tonnis, http://bit.ly/1oJzGsV

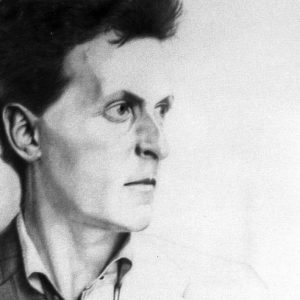

The philosopher Ludwig Wittgenstein once said that nothing is as difficult for people as not deceiving themselves. But while most self-delusions are relatively costless, those relating to investment can come with a hefty price tag.

We delude ourselves for a number of reasons, but one of the principal causes is a need to protect our own egos. So we look for external evidence that supports the myths we hold about ourselves, and we dismiss those facts that are incompatible.

Psychologists call this “confirmation bias”—a tendency to select facts that suit our own internal beliefs. A related ingrained tendency, known as “hindsight bias,” involves seeing everything as obvious and predictable after the fact.

These biases, or ways of protecting our egos from reality, are evident among many investors every day and are often encouraged by the media.

Here are seven common manifestations of how investors fool themselves:

- “Everyone could see that market crash coming.” Have you noticed how people become experts after the fact? But if “everyone” could see a correction coming, why wasn’t “everyone” profiting from it? You don’t need forecasts.

- “I only invest in ‘blue-chip’ companies.” People often gravitate to the familiar and to shares they see as solid. But a company’s profile and whether or not it is a good investment are not necessarily correlated. Better to diversify.

- “I’m waiting for more certainty.” The emotions triggered by volatility are understandable, but acting on those emotions can be counterproductive. Uncertainty goes with investing. Historically, long-term discipline has been rewarded.

- “I know about this industry, so I’m going to buy the stock.” People often assume that success in investment requires a specialist’s knowledge of a sector. But that information is usually already in the price. Trust the market instead.

- “It was still a good call, but no one saw this coming.” Isn’t that the point? You can rationalize a stock-specific bet as much as you like, but events or external influences can conspire against you. Spread your risk instead.

- “I’m going to restrict my portfolio to the strongest economies.” If an economy performs strongly, that will no doubt be reflected in stock prices. What moves prices is news. And news relates to the unexpected. So work with the market.

- “OK, it was a bad idea, but I don’t want to sell at a loss.” We can put too much faith in individual stocks, and holding onto a losing bet can mean missing opportunities elsewhere. Portfolio structure affects performance.

This is by no means an exhaustive list. In fact, the capacity for human beings to delude themselves in the world of investment is never-ending.

But overcoming self-deception is not impossible. It just starts with recognizing that, as humans, we are not wired for disciplined investing. We will always find one way or another of rationalizing an emotional reaction to market events.

But that’s why even experienced investors engage advisors who know them, and who understand their circumstances, risk appetites, and long-term goals. The role of that advisor is to listen to and acknowledge our very human fears, while keeping us in the plans we committed to at our most lucid and logical.

We will always try to fool ourselves. But to quote a piece of folk wisdom, the essence of self-discipline is to do the important thing rather than the urgent thing.

About the Author: Jim Parker, a vice president in the Communications Group of Dimensional Fund Advisors presents strategies to communicate Dimensional’s philosophy and process in ways that engage clients, prospects, regulators, and the media. Jim holds an economic history degree from Deakin University and a journalism degree from Auckland Technical Institute.